Imagine this: you’re about to send money through a new FinTech app. Suddenly, a wave of anxiety washes over you. Is your data secure? Will this transaction be safe? In 2024, with 422 million data records exposed in financial services alone (Identity Theft Resource Center, 2023), such concerns are valid. But what if FinTech apps became bastions of security, built around user experience (UX) principles that foster trust and empower users?

The Stakes: Why Security & Privacy Matter More Than Ever

Think beyond just data breaches. 72% of global consumers are more concerned about data privacy than a year ago (PwC, 2023). And 81% would abandon a FinTech app with security worries (Accenture, 2022). It’s not just about compliance; security and privacy are UX imperatives for trust and user adoption.

Securing the Digital Vault: Key UX Design Best Practices for 2024

Let’s go beyond generic advice and explore how UX can make security feel seamless and intuitive:

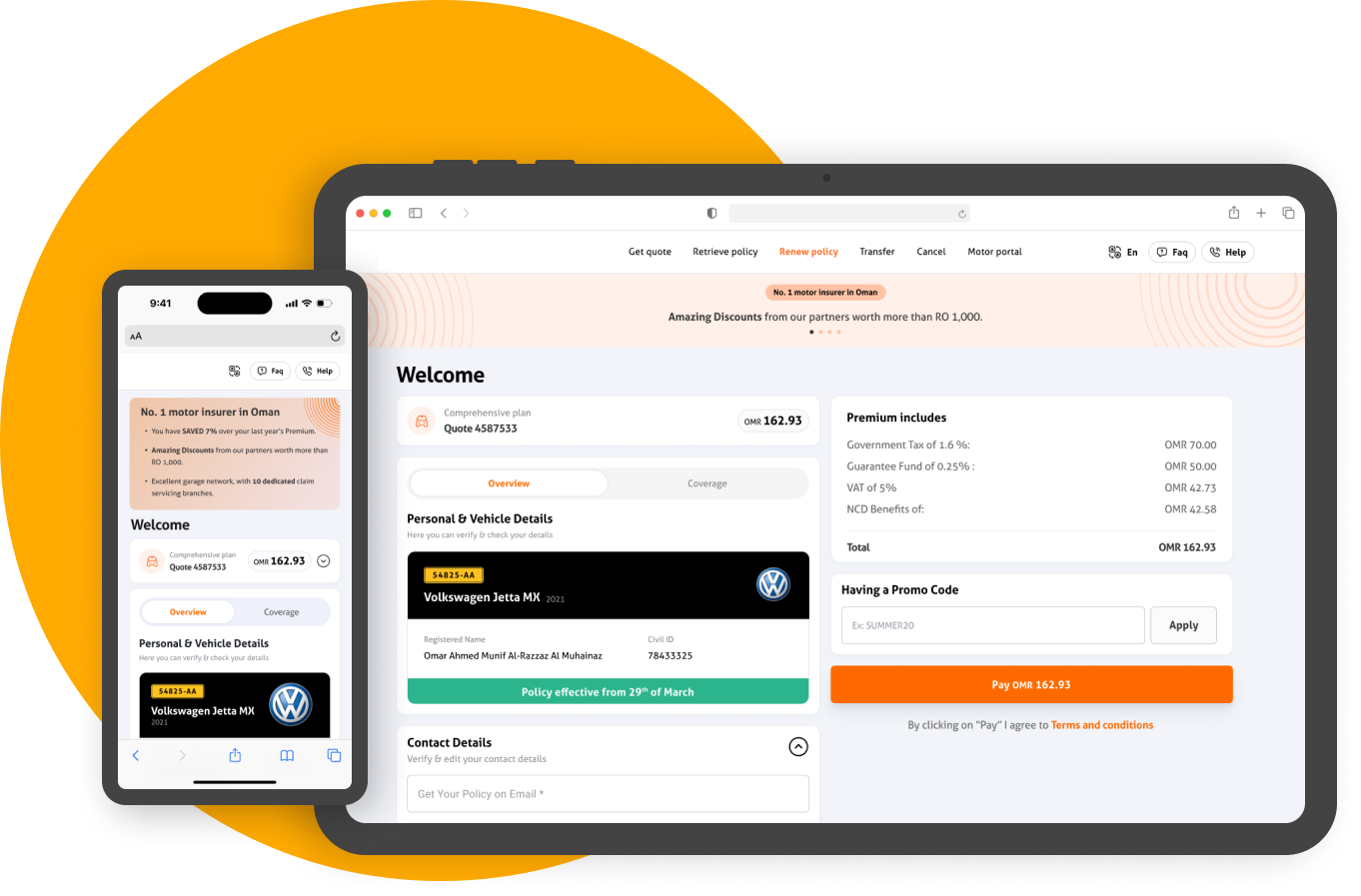

1. Multi-Layered Authentication: Beyond Passwords, Towards Frictionless Security

While multi-factor authentication (MFA) is crucial, consider risk-based authentication. Imagine logging in from your trusted device at home? Easy MFA. Logging in from a new location while transferring a large sum? The app might request fingerprint and facial recognition for an extra layer of security. This dynamic approach balances security with user experience.

2. Data Encryption: From Invisibility to User Control

The industry-standard AES-256 encryption is robust, but forward-thinking companies are exploring post-quantum cryptography (PQC). While widespread adoption is years away, understanding and implementing PQC-ready solutions demonstrates a commitment to future-proofing user data.

3. Data Minimization: Less is More (and More Meaningful)

Don’t just collect less data; focus on meaningful data collection. Gather information essential for core functionalities and user experience, like personalized financial insights. Avoid stockpiling irrelevant data that increases the attack surface and creates user distrust.

4. Transparency and Education: Building Trust Through Proactive Communication

Forget static privacy policies. Utilize interactive elements like data dashboards and personalized privacy reports. Partner with data privacy experts to conduct regular privacy impact assessments (PIAs) and communicate their findings in clear, user-friendly language. Remember, transparency builds trust.

5. Vigilant Monitoring and Response: From Reactive to Predictive Security

Real-time monitoring is key, but consider incorporating threat intelligence and machine learning to predict and prevent breaches. Invest in security information and event management (SIEM) solutions that aggregate data and provide actionable insights for security teams. This proactive approach empowers swift responses and minimizes user impact.

Privacy by Design: Putting Users in the Driver’s Seat

It’s not just about protecting data; it’s about respecting user autonomy. Here’s how UX can empower:

1. Granular Permission Management: Beyond Yes/No, Towards Informed Choice

Offer detailed explanations of what data is collected and for what purpose. Provide granular controls for specific functionalities and data access. Consider “need-to-know” options, allowing users to share only essential data for a specific task. Empowerment fosters trust.

2. Clear Opt-In and Opt-Out: From Frictionless to Friction-Right

While streamlining sign-up is important, don’t sacrifice informed consent. Offer clear and accessible opt-in options that explain data usage and privacy implications. Equally important, make opting out just as convenient. Remember, user control matters.

3. Data Erasure and Portability: From Right to Obligation

Data privacy regulations like GDPR and CCPA grant users the right to data erasure and portability. Go beyond compliance and make these features readily available within your app. Consider offering data anonymization options for users who value personalized experiences without sharing PII. Respecting user rights builds loyalty.

Beyond Best Practices: Building a Security-First Culture in 2024

Security is not a one-time project; it’s a cultural shift:

1. Security Champions: From Individuals to Ambassadors

Empower security champions across your organization, not just in IT. Encourage collaboration between design, development, marketing, and legal teams to foster a shared understanding of security risks and best practices. Train these champions to become internal advocates, educating colleagues and users alike.

2. Regular Security Audits: From Point-in-Time to Continuous Integration

Instead of annual penetration testing, embrace continuous security testing. Integrate automated security tools into your development pipeline to identify and address vulnerabilities early and often. Partner with external experts for regular red teaming exercises, simulating real-world attacks to test your defenses. This continuous vigilance ensures proactive security throughout the development lifecycle.

3. Continuous Improvement: From Reactive Updates to Proactive Innovation

Stay ahead of the curve by actively engaging with the evolving security landscape. Subscribe to industry publications, attend security conferences, and participate in vulnerability disclosure programs (VDPs). Encourage a culture of learning and experimentation within your team, exploring emerging security technologies like multi-party computation (MPC) and homomorphic encryption. Proactively implementing these solutions creates a future-proof security posture.

Remember: Security is not a Finish Line, It’s a Journey

Building a secure and trustworthy FinTech app is an ongoing commitment. By incorporating the UX-focused best practices outlined above, fostering a security-first culture, and continuously adapting to the evolving threat landscape, FinTech companies can:

- Build User Trust: 86% of users say they’d pay more for a secure FinTech experience (PwC, 2023). Prioritizing security translates to higher engagement and loyalty.

- Mitigate Risks: Data breaches can cost companies millions in fines and reputational damage. Proactive security measures minimize these risks.

- Thrive In the Digital Age: In a competitive landscape, security and privacy are differentiators. Building trust attracts and retains users, driving long-term success.

Galaxy UX Studio: Your Partner in Building Secure and Trustworthy FinTech Experiences

At Galaxy UX Studio, we understand the critical role of UX in building secure and trustworthy FinTech experiences. Our team of experienced designers, security experts, and user researchers collaborate with you to create:

- User-centric security features: We integrate robust security measures seamlessly into the user journey, ensuring a frictionless and secure experience.

- Data privacy by design: We empower users with granular control over their data, building trust and respecting their privacy rights.

- Future-proof security solutions: We stay ahead of the curve by exploring emerging technologies and implementing them strategically.

Ready to build a FinTech app that users can trust? Contact Galaxy UX Studio today for a free consultation and let’s discuss how we can help you achieve your security and privacy goals.